lending club approval odds

If youre struggling to get approved for a personal loan it may be due to a variety of factors. Applied on 326 and approved on 329.

7 Best Home Improvement Loans Of 2022 Money

Approval for credit and the amount for which you may be approved are subject to minimum.

. Here are six ways you can tackle your next personal loan application and boost your. RISE is offered only to residents in states where permitted by law. It requires a minimum credit history of two years.

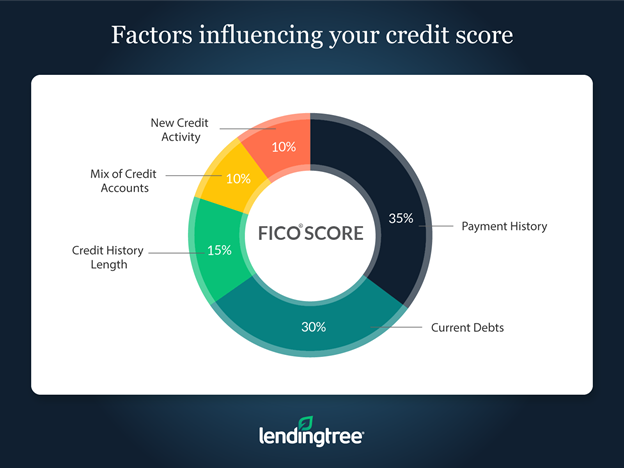

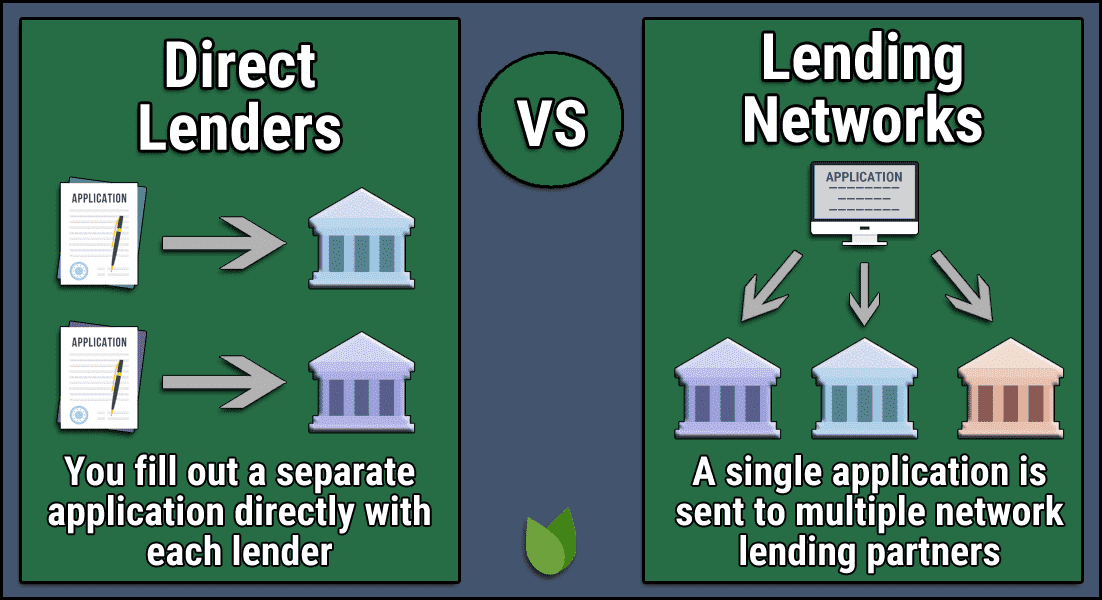

Your LendingClub approval odds are good if you have a low debt-to-income ratio and meet LendingClubs requirements to get a loan. Applications are subject to credit approval. At LendingClub you apply online and find out instantly whether youre pre-approved and what your offer is.

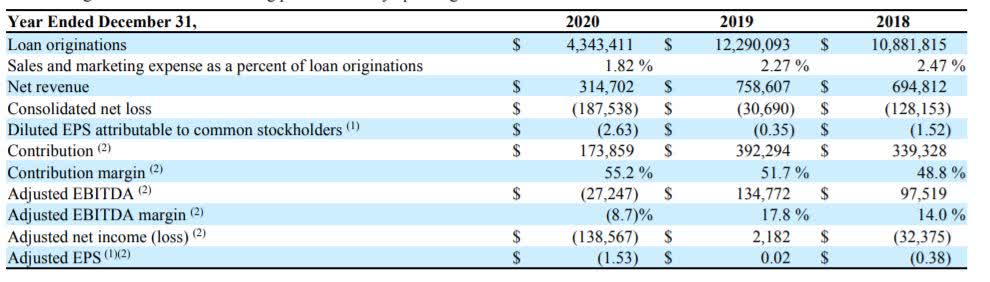

Lending Club formerly the largest peer-to-peer lending network is responsible for over 60 Billion in loans as of September 2020. Loan approval and the time it takes to issue a credit decision are. Some requirements include being at least.

Prospers timeline from loan approval to funding typically takes five to eight days potentially a few days longer. If you choose to take the offer we may ask you for documentation to verify your. If approved you will see your interest rate.

Get up to 40000 in just a few clicks. For example you could receive a loan of 6000 with an interest rate of 956 and a 500 origination fee of 300 for an APR of 1311. Unless otherwise specified all loans and deposit products are provided by LendingClub Bank NA Member FDIC Equal Housing Lender LendingClub Bank a wholly-owned subsidiary of.

Approval and funding time. To obtain credit you must apply online and have a valid checking account and email address. Revolving lines of credit are issued by Comenity Capital Bank Member FDIC.

The APR ranges from 1068 to 3589. With the ability to choose a loan amount of up to 40000 LendingClub offers fixed rates and a monthly repayment plan to fit within your budget. Between April 2022 and June 2022 Personal Loans issued by LendingClub Bank were approved within 2 hours on average.

Installment loans are issued by LendingClub Bank NA Member FDIC Equal Housing Lender LendingClub Bank a wholly-owned subsidiary of LendingClub Corporation NMLS ID 167439. Applied for a Personal Loan to pay off credit card debt with Lending Club and was approved for all 40000 at 749. Applications processed and approved before 6pm ET are typically funded the next business day.

Lendingclub Personal Loan Review

2022 Credit Card Approval Odds By Issuer

Sofi Vs Lendingclub Who Offers Better Personal Loans

Lending Club Review Can It Refinance You In 2022

7 Reasons Why Your Personal Loan Was Declined And How To Fix It

Lendingclub Personal Loans 2022 Review Nerdwallet

Lendingclub Review For 2022 Peer To Peer Personal Loans

Lendingclub Vs Prosper Which Lender Is Better Creditloan Com

Lendingclub Review High Value Personal Loans For Borrowers With Fair Credit

9 Best Personal Loans For Bad Credit 2022 Reviews Badcredit Org

Loan Denied Find Out Why Common Rejection Reasons

M T Bank Personal Loans 2022 Review Should You Apply Mybanktracker

Lending Club Reviews For Investors And Borrowers Is It Right For You

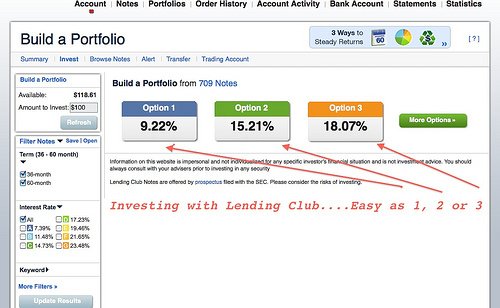

Examples Of How Lending Club Is Disrupting Traditional Investing With The Help Of Landing Pages

Lendingclub Now A Fintech Bank With The Possibility For A Massive Squeeze Higher Lc Seeking Alpha

Lending Club Reviews For Investors And Borrowers Is It Right For You

![]()

Lendingclub Review For 2022 Peer To Peer Personal Loans

Lending Club Review 2022 Is It A Good Investment For You

Amid Lending Club S Woes Is Peer To Peer Lending A Failure Money